Green-transition Finance in Egypt

Climate changes are increasing with each passing day, including in already-arid Egypt, where the population faces additional environmental stresses, including extreme temperatures, irregular precipitation, sea level rise and land subsidence, coastal flooding, shoreline erosion, deteriorating soil salinity, and persistent drought. These are also mutually reinforcing phenomena with impacts that will exacerbate each other, increasing water scarcity, thus hindering food security, displacing exposed populations, and destabilizing the Egyptian economy.

Climate change will, therefore, exert added pressures on already precarious populations and push still other groups to unprecedented levels of vulnerability and deprivation. Efforts to adapt to a changing climate will also exact a steep price, exposing existing governance shortcomings, deepening deficits and adding to an already-crippling debt burden. As climate change escalates pressures on state capacity, it will become even more urgent for the country to take proactive measures, including developing its climate governance to protect its vulnerable populations and maintain economic and social stability.

In response to the effects of climate change, Egypt has been the locus of numerous projects seeking both adaptation to, or mitigation of climate change with support from the major multilateral financing facilities. These efforts at “green transition” are the subject of review to help the general public understand the processes and trends underway in the country. While bilateral development cooperation and other public and private investments also could be described as “green finance,” the present inquiry tracks the international public funds dedicated to Egypt’s green transition since 2010.

Grounded in a preliminary study in 2022 Going Green: Monitoring the Green Transition in the Arab Region, in cooperation with its partners in the Arab Non-Governmental Organizations Network for Development (ANND), Housing and Land Rights Network (HLRN) has worked to develop reliable tools and easily accessible information and data on work related to climate change in “green transition” policies in Arab countries in 2022. More-complete and accessible information could enhance public understanding and engagement in both mitigation—i.e., efforts to reduce greenhouse-gas emissions (GHGE)—and adaptation, the efforts at evading or lessening the negative impacts of our warming planet. This effort is in response to the ongoing need for improved knowledge and public information about consequences climate change and the efforts to face them.

Research Method

This prospect was the motivation at HLRN to find ways to organize and present information to allow various publics to follow climate actions more easily. Meeting that first major challenge required gathering the currently scattered information into a single accessible format.

The present review was made possible by researching the websites of each of the major climate-finance mechanisms to collect project-specific information in a single research instrument. This was needed to create a single matrix with harmonized categories enabling the search across various criteria.

The projects were clustered by category: source (i.e., financial mechanism), development field, effect (mitigation or adaptation), project status, benefitting/ implementing sectors (private or public), and type of finance (loan, grant, equity, domestic source, or other). This has enabled the answers to emerge in response to several research questions summarized here.

The country-specific scope of this inquiry focuses only on Egypt so far, chosen because of its most-ambitious green-transition portfolio of the MENA region. However, similar methods and tools of inquiry could likewise be applied to other countries to visualize patterns and trends across that region, which shares so many climate-change issues, features and challenges.

Mitigation versus Adaptation?

Consistent with the trend across the MENA region as a whole, most externally funded green-transition efforts in Egypt have sought to reduce GHGE; whereas, adaptation measures form only one-third of projects. The 34 mitigation projects in Egypt are valued just over US$9 billion, while 10 adaptation projects have a combined value of just over US$35 billion. Only two of the projects reviewed, supporting financial institutions, could be classified as having both mitigation and adaptation effects.

The period since 2010 has seen 48 major projects funded by seven of the major climate-finance institutions to propel Egypt’s “green transition.” This report summarizes a review of the green financing from these sources only, which are separate from “green bonds” and smaller-scale projects carried out separately.

These projects are distributed across most development sectors, with nine projects in agriculture; 17 in the energy sector; six projects in the water and sanitation sector; one project in industry, mining and quarrying; two in the transport sector; four directly supporting financial institutions; two seek the preservation of natural resources; three in environmental and urban infrastructure; three addressing solid waste; with one operating humanitarian relief from climate events, namely, for Alexandria flood victims.

None of these greening projects operate explicitly in the housing sector. This is despite the significant contribution of housing and construction to GHGE and global warming, and instances of “green building” in Egypt reported elsewhere.

The Partners

This review covers those projects supported by the green-financing institutions and mechanisms of the:

- African Development Bank (AfDB)

- Climate Investment Fund (CIF)

- European Bank for Reconstruction and Development (EBRD)

- Green Climate Fund (GCF)

- Global Environment Facility (GEF)

- Middle East/North Africa Transition Fund (MENA) and

- World Bank (WB)

African Development Bank (AfDB) has funded the greatest number of green-transition projects in Egypt, totaling US$4.7 billion through loans and nearly US$1.05 billion as grants. These (six projects) are predominantly in the energy sector, with three in water and sanitation.

Climate Investment Fund (CIF) has funded two projects in energy and infrastructure, with one each pursuing adaptation and mitigation. Their total value is over US$30 billion in loans, with the bulk going toward sustainable urban infrastructure.

European Bank for Reconstruction and Development (EBRD) has sponsored the second largest number of individual projects (11) almost exclusively targeting mitigation. Five are in the energy sector, and three support financial institutions, with one each in natural-resource preservation and infrastructure works. Those have been relatively modest in value, totaling US$1,7 billion in loans and almost US$118 million in grants.

Green Climate Fund (GCF) has financed four projects, with three in energy, and one project to support finance institutions. One project, Transforming Financial Systems for Climate, spans 17 countries (including Egypt) across four sectors, including the singular project in this review potentially to support climate-change-related housing adaptation. Total GCF financing to reach Egypt amounts to almost US$223 million in loans and just under US$116 in grants.

The Global Environment Facility (GEF) has operated only three small mitigation projects in Egypt. All have been grants worth a total US$12.2 million.

Middle East/North Africa Transition Fund (MENA) is the least active of the green-financing institutions in Egypt. It has sponsored a single industrial-waster mitigation project with a grant of US$2 million.

Following the Money

The investment over the period since 2010 totals some US$44.53 billion from multiple sources and through various stages. Of these, Egypt has received most financing in the form of sovereign loans, amounting to over US$38.4 billion. A much smaller proportion of financing (US$2,244 billion) has come in the form of grants. About US$1.058 billion has come from domestic (public) sources, while only US$318.6 million has come from equity financing provided by investors.

While most of the climate-financing institutions operate with a basket of monies contributed by states and other public financing institutions, the biggest state contributors through this review period are concentrated in Europe, Japan, North America and Oceania.* Only one project, Helwan South Power Project, identifies a collective of funding sources in the MENA region, namely: the OPEC Fund for International Development, the Kuwait Fund for Arab Economic Development, the Islamic Development Bank, and the Arab Fund for Economic and Social Development.

As noted, Egypt’s largely successful “green bond” financing through the London stock exchange has yielded a reported billion to date. Since Egypt became the first country to offer sovereign climate bonds, or “green bonds,” in September 2020. That initiative, supported by the World Bank’s Government Debt and Risk Management (GDRM) Program, has been sponsored by the Swiss State Secretariat for Economic Affairs. In fiscal year 2023, the Government of Egypt is planning to issue $500 million worth of green bonds to finance several other green infrastructure projects. Further inquiry would be needed to determine to what extent revenue from these bonds figure in the ongoing repertoire of green-transition projects.

Private and Public Sector

Projects with public-sector beneficiaries and implementers number 15, out of the total 48 projects reviewed. These value US$5.15 billion in loans, and almost US$63 million in grants. By comparison, the 23 projects directed at private-sector beneficiaries and implementers involve just over US$32.5 in loans indebtedness incurred by Egypt, with US$68.6 million in grants and just under US$1 billion (US$984.10 million) in contributions from domestic public financing. Projects directed at both public and private sector beneficiaries are supported by US$750 million financing in the form of loans to Egypt. The total equity financing (from other investments) is only US$318 million, and all that private-source funding goes to mitigation projects.

With the information available from the seven major climate-finance mechanisms, at least three private corporations are the main recipients and beneficiaries of debt financing from AfDB to the Republic of Egypt. These are foreign-owned corporations: Delta Renewable Energy, owned by Delta Electronics (Americas) Ltd., based in California USA; Indian-owned Shahpoorji Pallonji; and Alcazar Energy Egypt Solar, owned by Alcazar Energy Partners (UAE). All of these are implementing solar-energy projects in Egypt under AfDB loans of around US$18 million each.

The World Bank (WB) has funded 10 green-transition projects in Egypt during this review period, and these are the earliest and oldest among them. Eight of them are dedicated to mitigation. All are spread across the energy, water-and-sanitation, transport and solid-waste sector. Only two of them remain in operation. Their total value is US$1.656 billion in loans, and US$947 million in grants. 20

It appears that all financing institutions aim to finance the activities of the private sector more than the public sector, especially in the field of energy. However, it cannot be said that any institution is specialized in a particular area of development, but diversify project financing across sectors. Only the African Development Bank (AfDB) appears to be more inclined toward energy and agriculture in projects funded in Egypt.

In 2022, ahead of the CoP27, hosted by Egypt, and the upcoming CoP28 in UAE,

Concluding Observations

From this snapshot of Egypt’s green transformation through the lens of current climate finance, we see wide and varied activity. The trend is promising, as Egypt has emerged as a leader in the region’s climate action and green transformation.

Access to information about these vital efforts is key to public engagement, but some difficulties remain. For example, each funding mechanism presents information about projects in its own way, and even in diverse currencies. Formats and types and presentations of data could be better harmonized, standardized and centralized to aid the public in accessing relevant information across the various financing mechanisms.

An imbalance remains in the approach to the climate crisis. Most projects work on mitigation, but few enable adaptation to what is to come. Both are urgent.

Other apparent trends deserve greater scrutiny and research effort. For example, the details of who benefits in the private and public sectors, respectively, are found in the implementation reports and evaluations of specific projects, most of which are still in process. Answers to these questions also would indicate the extent to which climate finance may affect national assets under state (i.e., public) management, or lead to greater privatization of vital public goods and services. The public debt burden and repayment prospects form another key area of public concern, requiring more analysis as US$38 billion of debt comes due.

While state-to-state discourse dominates the field, people-friendly and human-centered approaches are still needed to meet our common climate-crisis challenges together.

The relative absence of Arab countries from financing green transformation projects raises many questions, particularly about the divergence between domestic and external policies and behavior of individual states. On an encouraging note, at CoP27 in Sharm al-Shaikh, the Arab Coordination Group (ACG) committed $24 billion to address the climate crisis through South-South and triangular green financing by 2030.

It is vital for civil society to engage in the national, regional and global efforts at green transformation, both the mitigation and adaptation to advancing climate change. The issues concern us all, and climate action and the green transition emphasize just how the state and civil society are two sides of the same coin. The state-driven efforts and mechanisms must be consciously supported by civil society and vice versa. Civic participation in the progress to implement the promises made by the private and public sectors and external parties is vital to ensuring that these promises will be shared by—and benefit—all sectors of the state’s population.

This article was made possible by the contribution of researcher Shrouk Dhia, recent graduate in Business Administration (English) from `Ain Shams University, Cairo, Egypt.

* These are namely: Australia, Austria, Belgium, Canada, Cyprus, Czech Republic, Denmark, Estonia, EU, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Japan, Latvia, Lichtenstein, Lithuania, Luxembourg, Malta, Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom, and United States.

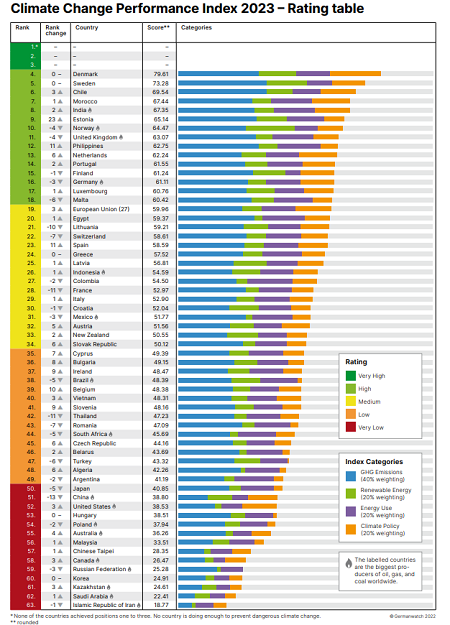

Photo on front page: Satellite view of northern Egypt and Red Sea. Source: Wallpapers. Image on this page: Climate Change Performance Index - Rating Table. Source: German Watch.

|