Green Transformation Finance in Jordan

Jordan is a country particularly vulnerable to climate change, with increasingly high temperatures and lower rainfall. Meanwhile, Jordan takes on the additional challenge of providing food, housing and public services to the estimated 3.35 million refugees (about a third of the population) currently living in the resource-poor country. Climate risks are increasing with each passing day, and residents need more information about the ongoing climate actions and their consequences. More complete and accessible information can enhance public understanding and participation in both mitigation efforts - efforts to reduce greenhouse gas emissions (GGE) - and adaptation, and efforts to avoid or reduce the negative impacts of a warming planet.

This constant need for public information is the reason why the Housing and Land Rights Network has developed reliable and accessible information and data tools on climate action in the “green transition” in Arab countries, based on a preliminary study Going Green: Monitoring the Green Transition in the Arab Region) in cooperation with the Arab Non-Governmental Organizations Network for Development (2022).

Research Method

Finding ways to organize and present information to allow the public to follow climate action more easily, addressing this first major challenge requires bringing together currently scattered information into a single accessible format.

This review was made possible by searching the websites of each of the major climate finance mechanisms to gather project-specific information into a single searchable tool. This was necessary to create a single matrix with rich categories that would allow searching across diverse rent criteria.

The projects were grouped by category: source (i.e., financial mechanism), development field, impact category (mitigation or adaptation), project status, beneficiary/implementing sectors (private or public), and financing type (loan, grant, equity, domestic sources). This configuration enabled answers to emerge in response to many of the research questions summarized here.

The scope of this country-specific research focused on Egypt and Jordan only so far, Egypt was chosen for its most ambitious green transition portfolio in the MENA region, and Jordan for its dynamic partners and daunting challenges. However, similar research methods and tools can also be applied to other countries to visualize patterns and trends across the region, which shares many of the climate change issues, characteristics and challenges.

Climate-finance Partners

This review covers projects supported by the principal green finance institutions and mechanisms of:

- Adaptation Fund (AF)

- Climate Investment Fund (CIF)

- European Bank for Reconstruction and Development (EBRD)

- Green Climate Fund (GCF)

- Global Environment Facility (GEF)

- Middle East/North Africa Transition Fund (MENATF) and

- World Bank (WB).

Of the seven main mechanisms for financing climate action in the MENA region, six have supported projects of varying sizes in Jordan since 2010. The MENA Transition Fund was the only one notably not involved in Jordan`s transformation during this period.

While most climate finance institutions operate with a basket of funds contributed by governments and other public financing institutions, the largest country contributors during this review period are concentrated in Europe, Japan, North America and Oceania. The Middle East and North Africa region does not contribute substantively so far. However, before the 27th Conference of the Parties at Sharm El-Sheikh in 2022, the Arab Coordination Group—which comprises the OPEC Fund for International Development, the Kuwait Fund for Arab Economic Development, the Islamic Development Bank, and the Arab Fund for Economic and Social Development—announced that it had pledged US$24 billion in climate financing for developing countries by 2030.

Mitigation v. Adaptation

In line with the trend in the MENA region as a whole, most of the externally funded green transition efforts in Jordan have sought to mitigate climate-change impacts (i.e., reduce greenhouse gas emissions—GGE), while adaptation projects constitute only about 26% of projects. The value of the 48 total projects in Jordan is just under US$6 billion, while the 38 mitigation projects combined are worth just over US$4.577 billion. Five of the projects reviewed, supporting financial institutions, can be categorized as having mitigation and adaptation effects in the same project.

Of the total of 48 projects since 2010, six cannot be easily classified as mitigation or adaptation projects. Five projects pursue both. Further review of projects might examine their “green transition” relevance (e.g., purchasing 136 diesel buses for the City of Amman).

These projects are distributed over most of the development sectors, including four projects in agriculture; ten in the energy sector’ four in the water and sanitation sector; none in industry, mining and quarrying; but two in transport; five that directly support financial institutions; ten that seek natural resource conservation; sixteen projects in environmental and urban infrastructure; and eight for waste treatment.

No greening project in Jordan is clearly operating in the housing sector. This is despite the significant contribution of housing and construction to global warming and warming, and cases of “green building” in Jordan that have been reported elsewhere.

European Bank for Reconstruction and Development has sponsored projects targeting almost exclusively municipal infrastructure: two for municipal transport, one for the solid waste management and three supporting financial institutions.

The Green Climate Fund has financed 13 projects: Five of them in the field of energy, and one project to support financial institutions. These projects cover several countries, one covering 40 countries, another 28 countries, one operating in eight countries and the other extending to six countries. The available project information does not specify the activities or values of the projects implemented in Jordan, or at any stage of the project. Therefore, details regarding their implementation cannot be ascertained, but we include them for the purpose of comprehensiveness.

The GEF has operated 25 relatively small projects in Jordan. All have received grants totaling less than $47 million, and all have an element of co-financing from a variety of domestic and extraterritorial sources, totaling approximately $41.4 million.

The Adaptation Fund has supported two projects in the water sector, but with implications for urban housing of displaced persons, as well as rural circular economies.

The MENA Transition Fund appears not to be active in Jordan. No project information related to Jordan is available on the MENATF website.

Follow the Money

The total investment during the period since 2010 amounts to about US$6 billion from multiple sources and through different stages. Of these sums, Jordan received most of the financing in the form of sovereign loans, with a value of over US$ 3.218 billion and much less funding (US$ 569 million) in grants. About US$218 million came from domestic (public) sources, while only about US$1.4 billion came from equity financing provided by investors.

Public and Private Sectors

The number of projects with beneficiaries and implementers from the public sector reached 40 projects out of a total of 48 projects reviewed. The value of these projects is estimated at US$2.75 billion, and approximately US$838 million is in grants. By comparison, the 11 projects targeting private sector beneficiaries and implementers involved just over US$54 million.

The World Bank has financed four green transition projects in Jordan during this review period designed to mitigate climate-change impacts. They are all spread across multiple fields, ranging from waste treatment, to energy and natural resources, financial institutions and supporting public investment in climate-responsive investment. These total US$3.218 billion in sovereign loans.

It seems that all financing institutions aim to finance the activities of the private sector more than the public sector, especially in the field of energy. However, it cannot be said that any institution specializes in a particular area of development, but diversifies project financing across sectors.

Concluding Observations

From this picture of Jordan`s green transition through the lens of current climate finance, we see broad and diverse activity.

Access to information about these vital efforts is essential for public engagement, but some difficulties remain. For example, each financing mechanism provides information about the project in its own way, and even in different currencies. Data formats, types and presentations can be better coordinated, standardized and centralized to help the public access relevant information across different funding mechanisms.

There remains an imbalance in the approach to the climate crisis. Most projects work to mitigate, but a few work to adapt to what is yet to come. Both are urgent.

Other clear trends deserve further scrutiny and research effort. For example, details of beneficiaries in the public and private sectors, respectively, are found in implementation reports and evaluations of specific projects, most of which are still under implementation. The answers to these questions also indicate the extent to which climate finance may affect national assets under state management (i.e., public administration), or may lead to greater privatization of vital public goods and services. Public debt burden and repayment prospects are another major area of public concern, which requires further analysis with the US$2.068 billion of debt maturing in future.

While state-to-state discourse dominates the field, there is still a need for a people-friendly and people-centered approach to address the common challenges of the climate crisis we face together.

The relative absence of Arab countries from financing green transformation projects raises many questions, especially about the difference between domestic and foreign policies and the behavior of individual countries. The Arab Coordination Group pledge of $24 billion for South-South and triangular green financing by 2030.

It is crucial for civil society to participate in national, regional and global efforts aimed at the green transition, whether mitigating or adapting to the effects of climate change. Issues that concern us all, and climate action and the green transition emphasize that state and civil society are two sides of the same coin. State-led efforts and mechanisms must have conscious support from civil society, and vice versa. Civic engagement in progressively implementing private and public sectors is vital to sharing efforts and benefit across all sectors of the state`s population.

Download a copy of the matrix with metadata.

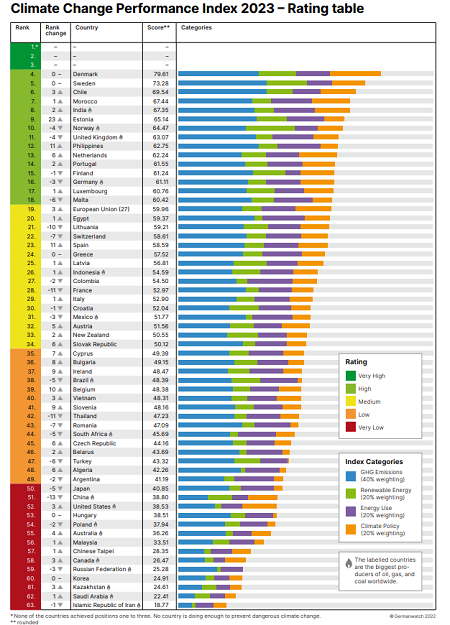

Photo on the main page: A satellite view of Jordan (center). Source: mapsland. Image on this page: Climate change performance indicator - classification table, source: German Watch.

|